Stock Market Update: Dow, S&P 500, and Nasdaq Futures Rise Following Nvidia Earnings Report

On Thursday, November 20, 2024, U.S. stock futures surged as investors closely analyzed Nvidia’s latest earnings report, reflecting growing interest in the future of AI-driven growth. The Dow Jones Industrial Average futures (YM=F) led the pack with a 0.5% increase, matched by similar gains in S&P 500 futures (ES=F) and Nasdaq 100 futures (NQ=F). This upward momentum came on the heels of a relatively subdued trading day for major indices.

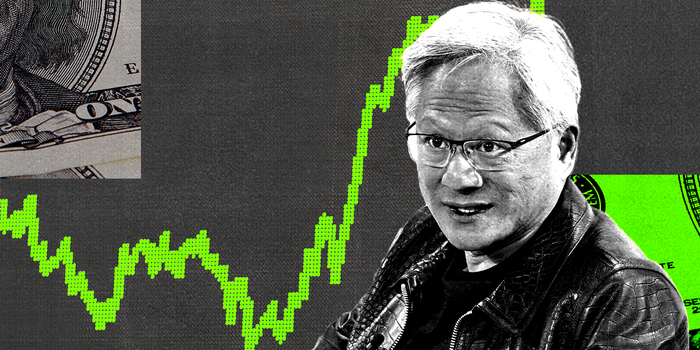

Nvidia’s third-quarter performance showcased impressive financial metrics, with the company reporting a revenue of $35.1 billion—up 17% from the previous quarter and a staggering 94% increase from the same period last year. The tech giant surpassed profit expectations, with GAAP earnings per diluted share reaching $0.78, up 16% quarter-over-quarter and up 111% year-over-year. However, the company forecasted its slowest revenue growth in seven quarters due to supply chain constraints impacting the availability of their new Blackwell chip.

Despite these headwinds, analysts suggested that demand for Nvidia’s chips is expected to significantly outpace supply, hinting at potential future revenue boosts once these issues are resolved. Nvidia’s stock experienced a recovery after initially dropping in pre-market trading, as investors weighed the implications of the earnings report on the ongoing AI boom.

In other tech news, Alphabet Inc. (GOOG, GOOGL) saw its shares dip following a request from the Department of Justice (DOJ) for a judge to compel the sale of Google Chrome, while discussions regarding potential changes to its Android business continued.

Market watchers also absorbed the latest jobless claims data, which indicated a decrease to 213,000 from an upwardly revised 219,000 the previous week. Investors are analyzing these figures to gauge the Federal Reserve’s potential decisions regarding interest rate cuts. Current trading sentiment suggests there is now a 44% likelihood of the Fed pausing interest rate changes at its upcoming December meeting, a notable increase from about 28% the week prior, according to the CME FedWatch tool.

Adding to the market’s attention, former President Donald Trump is reportedly gearing up to announce his Treasury Secretary pick, prompting discussions about the potential economic impacts of his cabinet choices.

In a noteworthy development in the cryptocurrency space, bitcoin surged to a new all-time high, surpassing $98,000 and nearing the significant $100,000 milestone. The momentum in the cryptocurrency market coincides with reports suggesting Trump’s team is considering appointing a White House crypto policy chief, which could further influence regulatory environments.

Nvidia’s Third Quarter Financial Results and Future Outlook

Nvidia’s earnings announcement on November 20 highlighted several key financial achievements and strategic advancements:

- Financial Highlights:

- Third-quarter revenue reached $35.1 billion.

- GAAP earnings per diluted share were reported at $0.78.

- Non-GAAP earnings were slightly higher at $0.81.

- CEO Jensen Huang on AI Transformations: “The age of AI is in full steam, propelling a global shift to NVIDIA computing,” said Jensen Huang, Nvidia’s founder and CEO. He noted escalating demand for their Hopper architecture and the anticipated Blackwell, emphasizing that AI is revolutionizing industries worldwide.

- Future Revenue Projections:

- For the next quarter, Nvidia expects revenue of approximately $37.5 billion, plus or minus 2%.

- The company projects GAAP gross margins of 73.0% and non-GAAP gross margins of 73.5%.

- Notable Achievements:

- Nvidia celebrated a record revenue of $30.8 billion from its Data Center segment—up 112% year-over-year.

- They have launched significant AI supercomputing projects globally, including partnerships with major cloud service providers and telecommunication leaders.

- Gaming and AI Initiatives:

- Gaming revenue for Q3 stood at $3.3 billion, reflecting both quarter-over-quarter and year-over-year growth.

- Nvidia recently introduced new AI PCs and celebrated the legacy of its original GPU, marking a pivotal moment in gaming and AI technology.

Overall, Nvidia’s robust earnings and strategic initiatives solidify its position as a leader in the AI and technology sectors, suggesting continued investor interest and confidence in the company’s growth trajectory. As the stock market reacts to these developments, all eyes will remain on the Fed’s actions, potential cabinet choices from Trump, and the ongoing dynamics within the AI and cryptocurrency markets.